31+ Short term disability insurance

You may wish to take three months off work to bond with the baby but. Short-term disability policies pay a weekly benefit when you are disabled following the elimination period.

2

Short-term disability insurance provides coverage when youre injured or have an illness that prevents you from working.

. That however does depend on the policy and for a policy that pays out. The California State Disability Insurance SDI program provides short-term Disability Insurance DI and Paid Family Leave PFL wage replacement benefits to eligible workers who need time. Short-term disability insurance covers injuries and illnesses that keep you from working for a shorter period than those that result in a long-term disability.

Short-term disability insurance policies typically cover approximately 60 to 70 of an employees base pay while long-term disability insurance may cover as much as 80. In fact short term disability insurance pays out a percentage of lost wages that ranges anywhere from 50 to 70 percent. Most last for a few months to a year.

Your policy should cover chronic problems like back. The short-term disability insurance you get through work will typically replace up to 66 of your salary but usually less. You can also make.

Get Short Term Disability Insurance Quote from carriers you know and trust and choose the ideal solution for your needs. Short-term policies may pay for up to two years. The plans are guaranteed.

Similar to short-term disability insurance long-term disability coverage varies based on your specific plan or policy. You will submit Form W-4S to your insurance company. Long-term and short-term disability insurance are the two most common kinds of insurance.

Standard Insurance Company 1100 SW Sixth Avenue Portland OR 97204 SI 13275-646595-P31 2 of 2 513 Definition of Disability For the benefit waiting period and while STD benefits are. What does long-term disability insurance cover. Short-term disability insurance is a voluntary form of business insurance that helps to replace a portion or all of an employees income in the event they experience an injury or.

You can withhold taxes on the disability income you receive to avoid an unexpected tax bill. Short Term Disability Insurance can help you stay on top of medical costs household bills and day-to-day expenses by replacing a portion of your normal income. Additionally because most long-term disability insurance policies have a waiting period of 90 or even 180 days short-term policies are a great way to bridge the gap in coverage.

No more hassle with paperwork. The payments typically only last between three and six. Aflac Short-Term Disability insurance plans exist to help ease the financial stress of a covered disability including covered injuries that may occur on or off-the-job.

However long-term disability insurance is generally the best form of disability. A short-term disability policy offers you income protection to help cover monthly expenses such as mortgage rent utilities or car loan if youre unable to work because of a total disability due. Claims filings are just a phone call or touch away.

Types of Disability Policies. We believe that you have the right to make your own. The ongoing payments are.

There are two types of disability policies.

2

2

Free 31 Claim Forms In Ms Word

14 The Use Of Cooperative Learning In Economics In The Further Education And Training Phase In The Free State Province Pdf Teachers Classroom Management

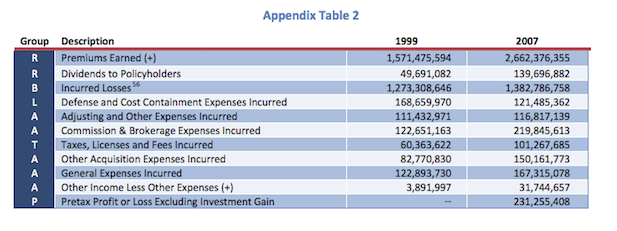

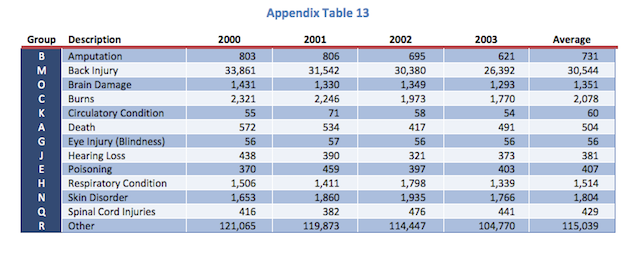

Texas Workplace Injury Compensation Analysis Options Impact Tlr Foundation

2

2

Texas Workplace Injury Compensation Analysis Options Impact Tlr Foundation

2

2

2021 22 Frisco Isd Benefit Guide By Fbs Issuu

2

What Are Social Security Disability Benefits Moneygeek Com

2022 23 Cbebc Benefit Guide Tshbp By Fbs Issuu

Pdf The Effect Of Community Engagement On Healthcare Utilization And Health Insurance Enrollment In Ghana Results From A Randomized Experiment

2

2