Student loan payment calculation fannie mae

Loan-Level Price Adjustments An LLPA applies to certain cash-out refinance transactions based on the LTV ratio and credit score. If the student loan payment on their credit report is 0 they use 05 of the outstanding loan balance as shown on the credit report.

How To Qualify For A Mortgage With Student Loan Debt Mortgage Blog

If the student loan is in deferment or forbearance and the credit report payment amount is missing or 0 lenders must calculate a qualifying payment by either using 1 of the outstanding student loan balance or a fully amortizing payment using the documented loan repayment terms.

. For conventional loans backed by Fannie Mae and Freddie Mac lenders now accept a DTI ratio as high as 50 percent. 2022 Fannie Mae Conventional Loan Guidelines For Student Loans. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

The term average prime offer rate is defined in 102635a2. Calculating Deferred Loan Payments. Be informed and get ahead with.

Of the loan to Fannie Mae Homestyle Renovation Loan Agreement Form 3731. Standard Agency Agency Plus and Agency Plus Select loan transactions. Conventional Loan 3 Down Available Via Fannie Mae Freddie Mac April 8 2015 3 Down payment mortgages for first-time home buyers April 21 2022 Do bi-weekly mortgage programs pay your mortgage.

Fannie Mae and Freddie Mac Government-Sponsored Enterprises GSE which package residential mortgages into securities allow higher debt levels for homebuyers with a significant student debt load. In this Chapter This chapter contains the following topics. Fannie Mae HomePath mortgage.

If your payment is based on a calculation that pays off your loan in full at the end of the loan term this is an amortized payment. Average prime offer rate. Fannie Mae Loan Programs This product description provides product guidelines and requirements for the following Fannie Mae loan programs.

When you apply for credit lenders evaluate your DTI to help determine the risk associated with you taking. That means a 20 down payment or greater when purchasing a home or 20 equity when refinancing a mortgage. All other components as used.

The loan-to-value ratio LTV ratio is a lending risk assessment ratio that financial institutions and others lenders examine before approving a mortgage. Topic Topic Name See Page 1 How to Underwrite a VA-Guaranteed Loan 4-2 2 Income 4-6 3 Income Taxes and Other Deductions from Income 4-25 4 Assets 4-27 5 Debts and Obligations 4-29 6 Required Search for and Treatment of Debts Owed to the Federal Government 4-34 7. A FICO Score is a three-digit number between 300 and 850 that tells lenders and other creditors how likely you are to make on-time bill payments.

Fully Amortizing Fixed Rate and Fully Amortizing 56-Month 76-Month and 106-Month SOFR ARMs. Writes I just switched my 30-year home mortgage to student loan Follow me for more financial advice I have been fielding questions about the impact of student loan forgiveness on credit probably wont impact credit scores but also whether the forgiven debt is taxable not at the Federal level but Forbes thinks it may be at the state level in some places. Low down payment no appraisal needed and no PMI January 23 2016 Fannie Maes mandatory waiting period after bankruptcy short sale pre-foreclosure is just 2.

In Real estate the term is commonly used by banks and building societies to represent the ratio of the first mortgage line as a percentage of the total appraised value of real propertyFor instance if someone borrows 130000 to purchase a house worth. Basically you want to be at or below 80 loan-to-value to avoid mortgage insurance entirely at least when it comes to a home loan backed by Fannie Mae or Freddie Mac. Even though this payment could be deferred for several years Fannie Mae wants lenders to make sure the borrower can afford the mortgage payment with the student loan.

High-cost mortgages include closed- and open-end consumer credit transactions secured by the consumers principal dwelling with an annual percentage rate that exceeds the average prime offer rate for a comparable transaction as of the date the interest rate is set by the specified amount. Note that there are maximum DTI ratios set by Fannie Mae Freddie Mac and the FHA that lenders use in underwriting as well. For the sake of this calculation a 30-year fixed-rate home loan is presumed with a rate at 5 APR.

It makes sense since eventually. For loan casefiles underwritten through DU when using the option of reducing the borrowers monthly qualifying income by the alimony or separate maintenance payment the lender must enter the amount of the monthly obligation as a negative alimony or separate maintenance income amountIf the borrower also receives alimony or separate. Mortgage payment student loans Documentation used to develop a nontraditional credit history including.

Not only does it help lenders evaluate the level. That means half of your monthly income is going toward housing expenses and. For conventional loans the maximum can range from 43 percent to 45.

Rental income calculation worksheet if used by lender Component required for all loan applications. Federal Housing Administrations FHA Maximum Loan Limits Effective October 1 2011 through December 31 2011-- Attachment 1 - Areas at Ceiling and Above-- Attachment 2 - Areas Between Floor and Ceiling. Loans qualified as student loan cash-out refinances must be delivered to Fannie Mae with Special Feature Code SFC 003 and SFC 841.

Loan-To-Value Ratio - LTV Ratio. For instance if you have 10 years left to pay on your current loan and you then stretch out the payments into a new 30-year loan you will end up paying more in interest overall to borrow the. Trial Payment Plan for Loan Modifications and Partial Claims under Federal Housing Administrations Loss Mitigation Program.

In addition to your credit score your debt-to-income DTI ratio is an important part of your overall financial healthCalculating your DTI may help you determine how comfortable you are with your current debt and also decide whether applying for credit is the right choice for you. The loan-to-value LTV ratio is a financial term used by lenders to express the ratio of a loan to the value of an asset purchased. Fannie Mae allows lenders to use one of two methods when determining the required payment on a deferred loan.

Who Has Student Loan Debt In America The Washington Post

What S The Typical House Down Payment Life And My Finances

Who Has Student Loan Debt In America The Washington Post

This Is How Student Loan Debt Became A 1 7 Trillion Crisis

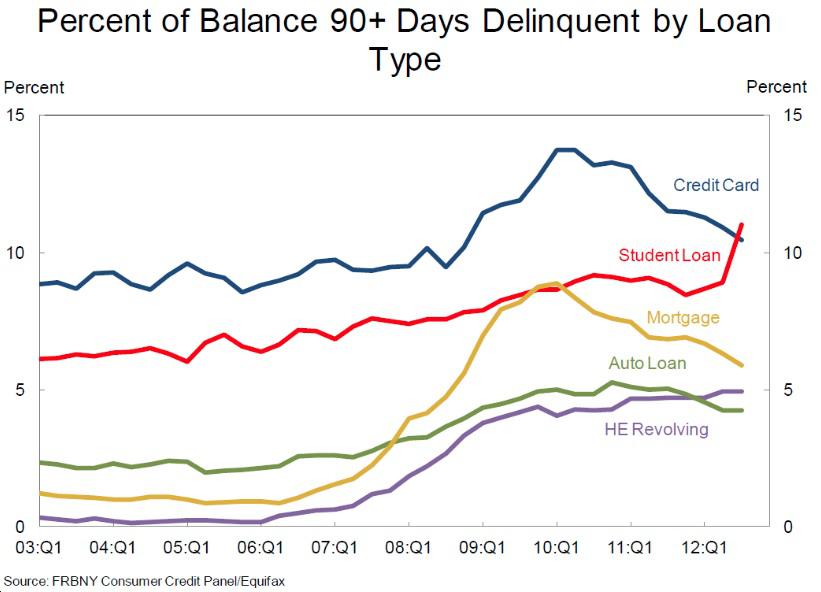

Student Debt A Trillion Dollar Bubble Seeking Alpha

New Update Fha Changes Calculation On Student Loan Payments First Time Home Buyer Youtube

Helpful Infographic Of How The Loan Process Works Find A Realtor Loan Mortgage

Fannie Mae 2022 Rules For Student Loan Payments Are Calculated In Your Debt To Income Ratio Arrivva

Get Our Image Of Real Estate Investment Analysis Template Mortgage Comparison Investment Analysis Income Property

5 Items To Know When Buying A House With Student Loans

2022 Guide To Qualifying For A Mortgage With Student Loans Find My Way Home

/mortgagemarvel/Student_Loan_Credit_Report_Example-sef94.jpg)

How Can Student Loans Affect A Mortgage Approval

This Study Explains The Relationship Between Home Prices And Student Loan Default Rates Why Lower House Student Loan Default Student Loans Student Loans Funny

How Can Student Loans Affect A Mortgage Approval

How To Qualify For A Mortgage With Student Loan Debt Mortgage Blog

What Is Cmhc Insurance And Why Do Lenders Require It Read More Paying Off Mortgage Faster Insurance Premium Mortgage

This Study Explains The Relationship Between Home Prices And Student Loan Default Rates Why Lower House Student Loan Default Student Loans Student Loans Funny